Short-Term vs. Long-Term ROI: What to Expect.

## Implementing an Effective Time-Based ROI Framework ### Step 1 - Baseline Current Performance Before implementing any AI system, establish clear baseline metrics across multiple time horizons - -...

Implementing an Effective Time-Based ROI Framework

Step 1: Baseline Current Performance

Before implementing any AI system, establish clear baseline metrics across multiple time horizons:

- Current efficiency metrics: Process costs, cycle times, error rates - Experience metrics: Customer satisfaction, NPS, retention rates - Strategic indicators: Market share, competitive positioning, growth rates

These baselines provide the foundation for meaningful before/after comparisons at each stage of the AI value journey.

Step 2: Define Success Criteria by Time Horizon

For each AI initiative, explicitly define what success looks like at different time intervals:

- 3 months: Initial implementation complete, early adoption metrics - 6 months: First efficiency gains visible, operational improvements - 12 months: Process transformation metrics, initial experience enhancements - 18-24 months: Strategic advantage indicators, competitive differentiation - 36+ months: Business transformation metrics, market leadership indicators

This timeline approach prevents premature judgment while establishing clear accountability for progressive value creation.

Step 3: Create a Balanced Measurement System

Develop a measurement framework that balances different types of returns:

1. Financial metrics: Direct cost savings, revenue impacts, margin improvements 2. Operational metrics: Process improvements, quality enhancements, resource utilization 3. Experience metrics: Customer and employee experience improvements 4. Strategic metrics: Competitive positioning, market creation, innovation indicators

The most effective frameworks weight these categories differently across time horizons, with financial metrics dominating short-term evaluation and strategic metrics becoming increasingly important for long-term assessment.

Step 4: Implement Regular Review Cycles

Establish a regular cadence for reviewing AI ROI across different time horizons:

- Monthly: Operational metrics and immediate financial returns - Quarterly: Enhanced experience metrics and medium-term value indicators - Annually: Strategic positioning and long-term value creation assessment

These reviews should include stakeholders representing different time horizons to maintain balanced perspective on progress.

Real-World Examples of Time-Based AI ROI

Manufacturing: Predictive Maintenance

A manufacturing company implementing AI-powered predictive maintenance might see returns unfold across these timelines:

Short-term (0-6 months): - 15% reduction in unplanned downtime - 20% decrease in emergency maintenance costs - 8% improvement in maintenance staff utilization Medium-term (6-18 months): - 30% extended equipment lifespan - 25% reduction in spare parts inventory - 18% improvement in production quality Long-term (18+ months): - Shift from equipment ownership to performance-based models - Development of maintenance-as-a-service business lines - Competitive differentiation through reliability guarantees

This progression illustrates how initial efficiency gains evolve into strategic advantages over time.

Financial Services: Risk Assessment

A financial institution deploying AI for loan risk assessment might experience:

Short-term (0-6 months): - 40% faster application processing - 25% reduction in manual review requirements - 15% decrease in processing costs Medium-term (6-18 months): - 10% reduction in default rates - 20% improvement in risk-adjusted returns - Enhanced ability to serve previously marginal segments Long-term (18+ months): - Development of proprietary risk models - Creation of new financial products for underserved markets - Fundamental shift in competitive positioning

The initial operational improvements provide the foundation for strategic transformation, but require patience before full value materializes.

Communicating AI ROI Across Time Horizons

Executive Dashboards for Time-Based Value

Effective AI ROI communication requires dashboards that explicitly track value across time horizons:

1. Efficiency dashboard: Tracking immediate returns from process improvements 2. Experience dashboard: Monitoring medium-term experience enhancements 3. Strategic dashboard: Assessing long-term competitive positioning and market creation

These dashboards should visually indicate which metrics are expected to move at which points in time, preventing misaligned expectations.

Narrative Development for Long-Term Value

Beyond metrics, organizations need compelling narratives that connect short-term indicators to long-term strategic value. These narratives should:

1. Explain how early operational improvements create the foundation for strategic advantage 2. Connect current metrics to future strategic outcomes 3. Demonstrate progress along the path from efficiency to transformation 4. Acknowledge the compounding nature of AI returns over time

For example, a customer service AI implementation might begin with cost reduction metrics but evolve into a narrative about how accumulated interaction data is creating an insurmountable experience advantage over competitors.

Conclusion: Embracing the Full AI Value Timeline

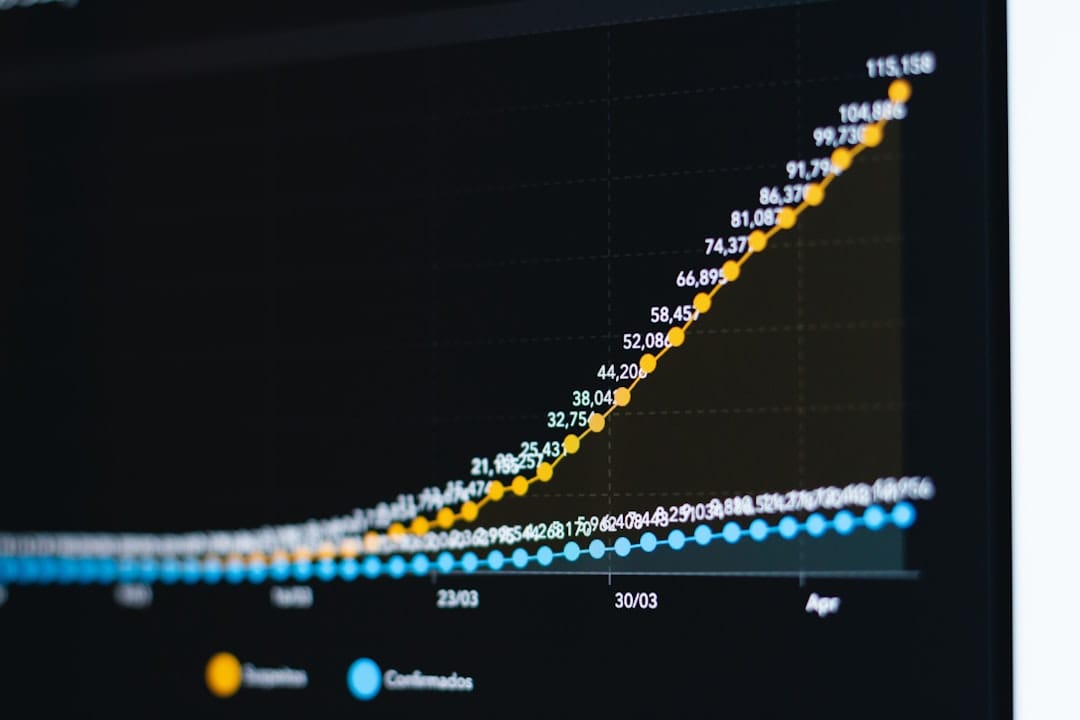

AI investments rarely follow traditional ROI patterns. Unlike many technology investments that deliver immediate returns followed by diminishing value, AI often follows the opposite trajectory - modest initial returns followed by accelerating value as data accumulates and organizational capabilities mature.

This pattern requires a fundamental shift in how organizations approach ROI expectations:

1. Balance patience with accountability: Maintain long-term vision while establishing clear milestones 2. Develop multi-horizon metrics: Create measurement systems that span efficiency, enhancement, and transformation 3. Build a portfolio approach: Maintain a mix of quick-win and strategic AI investments 4. Communicate across time horizons: Help stakeholders understand when different types of returns will materialize

Organizations that master this balanced approach to AI ROI timing will not only justify their investments more effectively but will also be positioned to capture the most significant long-term strategic value from their AI initiatives.

By setting realistic expectations about when different types of returns will materialize—from immediate cost savings to long-term competitive advantages—businesses can make more informed AI investment decisions and maintain the organizational patience required to realize AI's full transformative potential.